What Is a Certified Appraisal?

A certified appraisal is an opinion of value performed by a qualified appraiser. Such an appraisal is referred to as certified because it is accepted by a professional, governmental, or regulatory body.

The process of certified appraisal for tax purposes is typically carried out for real estate, art, or other valuable property/asset. A certified appraisal is often required for legal purposes, such as estate, tax, or insurance purposes.

The Need for a Certified Appraisal for Tax Purposes

When it comes to taxation, the Internal Revenue Service (IRS) requires that taxpayers accurately report the value of their assets as they are subject to taxation. To ensure that the taxable value is correctly determined, a certified appraisal is required in most cases.

The IRS requires that a certified appraisal be performed by a qualified appraiser. It is essential that the appraiser be certified by a recognized professional appraisal organization to be eligible to carry out an appraisal. It is also important for qualified appraisers to be knowledgeable as well as experienced in their field of expertise.

Now that we know what a certified appraisal is, let’s find out the reasons why a certified appraisal for tax purposes needs to be performed.

Accurate Valuation:

The IRS requires taxpayers to report the fair market value (FMV) of their assets that are subject to taxation. The FMV is the price that a willing buyer and seller would agree to during a transaction. Determining the FMV of an asset can be complex, but a qualified appraiser can help ensure that the valuation is accurate. This is important to avoid penalties and interest on underpayment or overpayment of taxes that result from inaccurate valuations.

IRS Requirements:

The IRS has specific requirements for appraisals done for tax purposes. For example, an appraisal must be completed by a qualified appraiser to meet IRS requirements.

A qualified appraiser must have a minimum level of education and experience and must regularly engage in appraisals for which they are qualified. Additionally, the appraisal report must meet specific content requirements and must be attached to the tax return that reports the valuation.

Avoiding Penalties:

Inaccurate valuations can result in penalties and interest on underpayment or overpayment of taxes. The IRS can impose a penalty of 20% on the underpayment of taxes due to a substantial valuation misstatement. The penalty can increase to 40% if the misstatement is due to gross valuation misstatement.

The IRS can also impose a penalty of 20% on the overpayment of taxes due to a substantial valuation misstatement. A certified appraisal can help avoid these penalties by ensuring an accurate valuation.

Supporting Tax Returns:

A certified appraisal can provide support for the value reported on a tax return. In the event of an audit, the taxpayer can use the appraisal report to show how they arrived at the reported value. The appraisal report can also help the taxpayer defend against challenges to the reported value by the IRS.

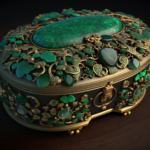

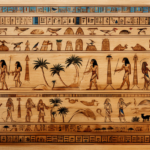

Specialized Appraisals:

Certain types of assets require specialized appraisals. For example, the valuation of artwork, collectibles, or real estate can be complex and require specialized knowledge and experience. A certified appraiser who specializes in a particular field of expertise can provide a more accurate valuation that takes into account the specific characteristics of the asset.

What Role Does a Qualified Appraiser Play In a Certified Appraisal for Tax Purposes?

A qualified appraiser is responsible for assessing the value of a property/asset and providing an accurate and impartial assessment of their market value. The appraiser will use their knowledge and experience to analyze data related to the property and its surrounding area.

This could be related to recent sale prices of comparable properties, to come up with an accurate appraisal. A tax assessor uses the appraiser’s findings to determine the property’s value for taxation purposes.

Qualified Appraisers from Appraisily Can Help You

A certified appraisal is essential for tax purposes to ensure an accurate valuation and to comply with IRS requirements. A qualified appraiser can provide specialized knowledge and experience for valuing specific types of assets/properties. The appraisal report can support the reported value on a tax return and help avoid penalties and interest on underpayment or overpayment of taxes.

Taxpayers should consult with a qualified tax professional to determine when a certified appraisal is necessary. Appraisers from Appraisily can help and guide you on how to obtain one that meets IRS requirements.